Introduction

Are you tired of the hassle of manually transferring finances between your bank account and PayPal? Look no farther! In this composition, we will show you the step- by- step process of connecting your bank account with PayPal, making online deals smoother and more effective. By linking your bank account to your PayPal account, you will be suitable to seamlessly transfer plutocrat, admit payments, and withdraw finances with just a many clicks.

No more worrying about delayed transfers or clumsy sale processes. Whether you are a small business proprietor, freelancer, or an individual looking for a more accessible way to manage your finances, connecting your bank account to PayPal is a game- changer. Imagine the time and trouble you will save by barring the need to manually move plutocrat between accounts. So, if you are ready to streamline your fiscal deals and witness the convenience of a connected bank account and PayPal, read on. Follow our easy- to- understand companion, and soon you will be enjoying the benefits of a seamlessly integrated online payment system.

Benefits of Connecting Bank Account with PayPal

Connecting your bank account with PayPal offers a range of benefits that can greatly simplify your financial transactions. Let’s explore some of the key advantages:

1. Convenience and Efficiency Linking your bank account to PayPal allows for flawless and instant transfers between the two accounts. This eliminates the need to manually transfer finances, reducing the threat of crimes and saving you precious time.

2. Secure Deals PayPal uses advanced security measures to cover your fiscal information. When you connect your bank account, you can enjoy the peace of mind that comes with knowing your deals are secure and your sensitive data is translated.

3. Availability Having your bank account connected to PayPal means you can pierce your finances from anywhere, anytime. Whether you are on the go or working ever, you can fluently manage your finances and make deals with just a many clicks.

4. Enhanced Payment Options When your bank account is linked to PayPal, you can enjoy a wider range of payment options. You can use PayPal to make purchases online, pay bills, shoot plutocrat to musketeers and family, and indeed admit payments for your products or services.

5. bettered Record- Keeping By connecting your bank account with PayPal, you gain access to detailed sale history and statements, making it easier to keep track of your finances. This can be especially salutary for small business possessors or freelancers who need accurate records for duty purposes.

Step-by-Step Guide to Connecting Bank Account with PayPal

Congratulations! You have successfully connected your bank account with PayPal. You can now start enjoying the benefits of seamless financial transactions.

Now that you understand the benefits, let’s dive into the step- by- step process of connecting your bank account with PayPal .

1. Log in to Your PayPal Account First, log in to your PayPal account using yourcredentials.However, you will need to subscribe up for one before you can do, If you do not have a PayPal account yet.

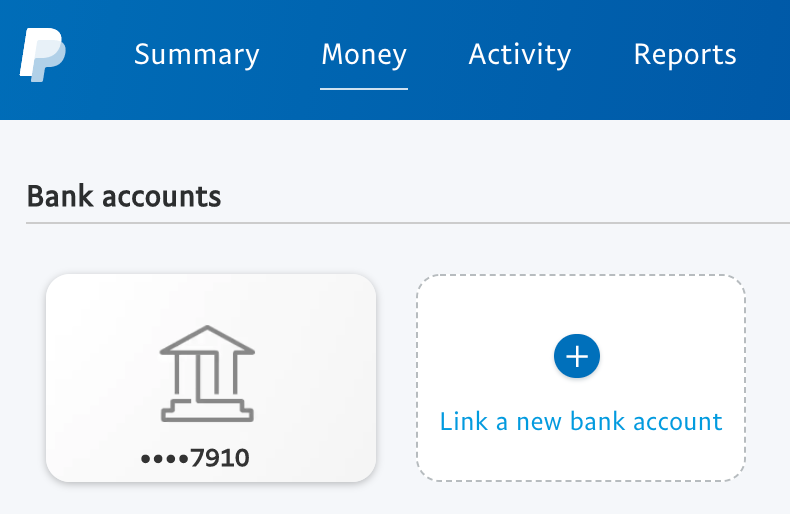

2. Navigate to the Wallet Section Once you are logged in, navigate to the” Wallet” section of your PayPal account. This is where you can manage your linked bank accounts and other payment styles.

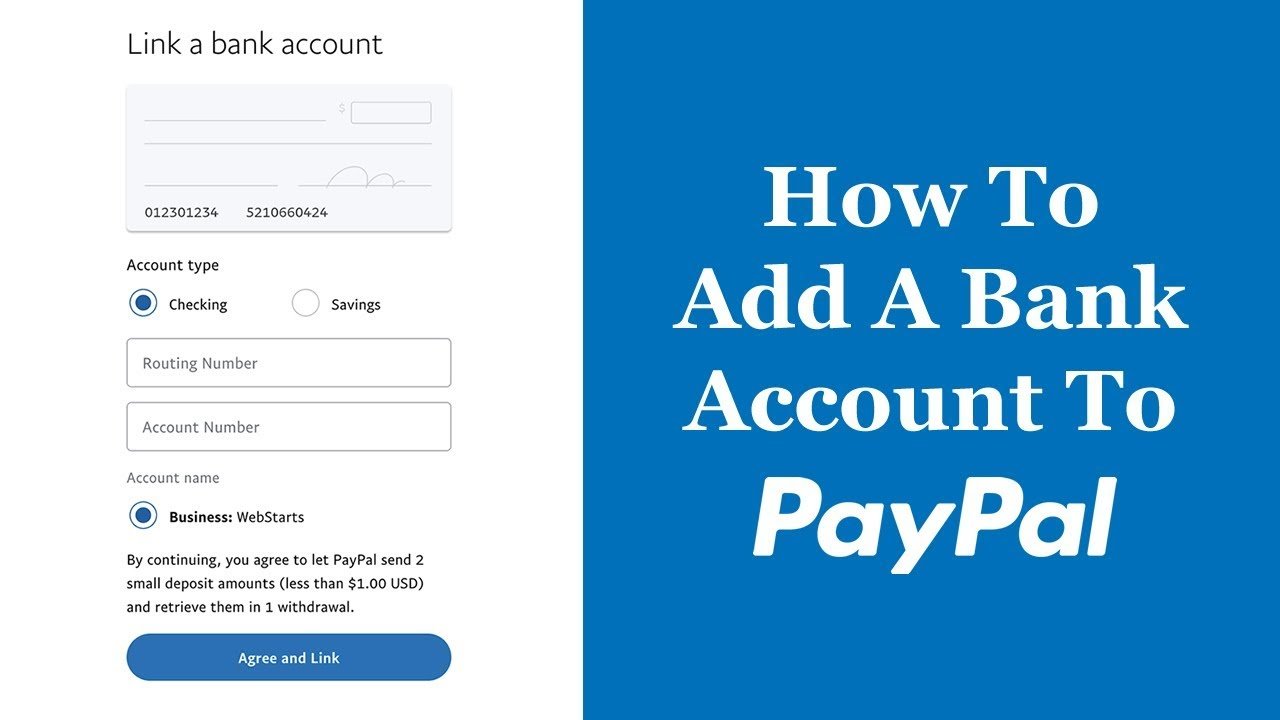

3. Add a Bank Account In the Wallet section, find the option to” Link a Bank Account” or” Add Bank Account.” Click on it to start the process of connecting your bank account.

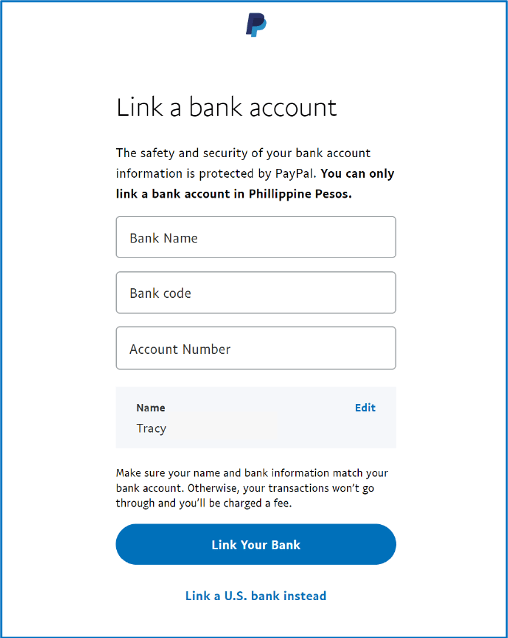

4. elect Your Bank You will be presented with a list of banks to choose from. elect your bank from thelist.However, you may need to manually enter your account details, If your bank isn’t listed.

5. Authenticate Your Bank Account To corroborate that you’re the account holder, PayPal may ask you to give fresh information or login credentials for your online banking. Follow the instructions handed by PayPal to complete the authentication process.

6. Confirm the Connection Once your bank account is successfully authenticated, PayPal will confirm the connection. You will admit a announcement or dispatch attesting that your bank account is now linked to your PayPal account.

Troubleshooting Common Issues when Connecting Bank Account with PayPal

While connecting your bank account with PayPal is generally a smooth process, you may encounter some common issues. Then are a many troubleshooting tips to help you overcome them

1. Incorrect Bank Account Details Make sure that you have entered the correct bank account information, including the account number and routing number. Double- check the details before submitting them.

2. inadequate finances insure that you have sufficient finances in your bank account to complete the connectionprocess.However, your bank may reject the connection request, If there are inadequate finances.

3. Bank Account formerly Linked still, contact PayPal’s client support for backing, If you are entering an error communication stating that your bank account is formerly linked to another PayPal account. They will guide you through the process of resolving this issue.

4. Specialized Glitches In rare cases, specialized glitches may do during the connectionprocess.However, try clearing your cybersurfer cache, using a different cybersurfer, If you encounter any crimes or issues. Flash back, if you are passing difficulties, PayPal’s client support is available to help you resolve any problems and insure a smooth connection of your bank account.

Tips for Keeping Your Bank Account Secure when Using PayPal

While PayPal takes extensive security measures to protect your financial information, it’s always important to take additional precautions to safeguard your bank account. Here are some tips to help you keep your bank account secure when using PayPal:

1. Use Strong and Unique Passwords

Create a strong and unique password for your PayPal account. Avoid using the same password for multiple accounts, and consider using a password manager for added security.

2. Enable Two-Factor Authentication

Enable two-factor authentication (2FA) for your PayPal account. This adds an extra layer of security by requiring a verification code in addition to your password when logging in.

3. Monitor Your Account Activity

Regularly monitor your PayPal account for any unauthorized transactions or suspicious activity. Report any concerns to PayPal immediately.

4. Be Wary of Phishing Attempts

Beware of phishing attempts, where fraudsters try to trick you into revealing your sensitive information. Always verify the authenticity of emails or messages claiming to be from PayPal before providing any personal or financial details.

5. Keep Your Devices Secure

Ensure that the devices you use to access your PayPal account are secure. Use up-to-date antivirus software, avoid public Wi-Fi networks when accessing sensitive information, and keep your operating system and applications updated.

By following these tips, you can enhance the security of your bank account when using PayPal and minimize the risk of unauthorized access or fraudulent activity.

Alternatives to Connecting Bank Account with PayPal

While connecting your bank account with PayPal offers numerous benefits, it’s always good to explore alternative options to see what works best for your specific needs. Here are a few alternatives to consider:

1. Credit/Debit Card Payments

2. If you’re uncomfortable linking your bank account to PayPal, you can still make payments using your credit or debit card. PayPal accepts a wide range of card payments, providing a convenient and secure way to transact online.

3. Digital Wallets

4. Digital wallets like Apple Pay, Google Pay, and Samsung Pay offer alternative methods for online payments. These wallets securely store your card information, allowing you to make payments without directly sharing your bank account details.

5. Payment Processors

6. Consider using other payment processors like Stripe, Square, or Amazon Pay. These platforms offer similar functionality to PayPal and can be integrated into your online store or website.

Remember, it’s essential to research and compare the features, fees, and security measures of different payment options to find the one that aligns best with your requirements.

Frequently Asked Questions about Connecting Bank Account with PayPal

1. Is it safe to connect my bank account with PayPal?

Yes, PayPal employs industry-standard security measures to protect your financial information. However, it’s always important to follow best practices for online security and monitor your account activity regularly.

2. Can I connect multiple bank accounts to my PayPal account?

Yes, PayPal allows you to link multiple bank accounts to your PayPal account. This can be beneficial if you have accounts with different banks or if you want separate accounts for personal and business use.

3. Are there any fees associated with connecting my bank account to PayPal?

Typically, PayPal does not charge fees for linking your bank account. However, it’s essential to review PayPal’s fee structure for specific details, as fees may apply for certain transactions or services.

4. Can I remove or change my linked bank account later?

Yes, you can remove or change your linked bank account at any time. Simply access the Wallet section of your PayPal account and follow the instructions to manage your linked accounts.

5. What should I do if I encounter an error while connecting my bank account?

If you encounter any errors or issues during the connection process, reach out to PayPal’s customer support for assistance. They have dedicated teams to help resolve any problems you may encounter.

Best Practices for Managing Your Finances with PayPal

To make the most of your bank account and PayPal integration, consider the following best practices:

1. Keep Track of Your Transactions

2. Regularly review your PayPal transaction history and bank account statements to ensure accuracy and detect any discrepancies.

3. Set Up Notifications

4. Enable notifications from PayPal to receive alerts about account activity, payments received, or withdrawals. This helps you stay informed and quickly address any issues.

5. Maintain a Separate Business Account

6. If you’re a business owner, consider keeping your personal and business finances separate. Set up a dedicated bank account and PayPal account for your business transactions to simplify record-keeping and accounting.

7. Stay Informed about PayPal’s Policies and Updates

8. Keep yourself updated with PayPal’s terms of service, policies, and any changes that may affect your account. This ensures that you’re aware of any updates or requirements that may impact your financial transactions.

9. Regularly Review Your Security Settings

10. Periodically review and update your security settings, including passwords, 2FA, and notification preferences. This helps ensure that your account remains secure and protected.

By following these best practices, you can effectively manage your finances with PayPal and maximize the benefits of having your bank account connected.

Resources and Additional Information for Connecting Bank Account with PayPal

For further information and resources related to connecting your bank account with PayPal, consider exploring the following:

1. PayPal Help Center

2. Visit the official PayPal Help Center for comprehensive guides, FAQs, and troubleshooting tips related to connecting bank accounts and other PayPal features.

3. PayPal Community

4. Engage with the PayPal community by joining forums and discussions where users share their experiences, tips, and solutions to common issues.

5. Official Bank Websites

6. Check your bank’s official website for specific instructions or guidelines on connecting your bank account with PayPal. They may provide additional information or support tailored to their customers.

Remember, being well-informed and utilizing available resources can help you successfully navigate the process of connecting your bank account with PayPal.

Conclusion

Connecting your bank account with PayPal unlocks a world of convenience and efficiency for managing your financial transactions. With seamless transfers, enhanced payment options, and improved record-keeping, you can streamline your online transactions and save valuable time.

By following our step-by-step guide and implementing the best practices outlined in this article, you can connect your bank account with PayPal securely and enjoy the countless benefits it offers.

Remember to prioritize security, stay informed about PayPal’s policies and updates, and explore alternative payment options that align with your needs. With a connected bank account and PayPal, you’ll experience a new level of simplicity and ease when it comes to managing your finances online.